Caracas: Venezuela’s currency has suffered another sharp deterioration as tightening US sanctions and restricted access to official dollar markets pushed the bolívar, dollar exchange rate up nearly 480% over the past year, deepening pressure on households and businesses.

Central Bank of Venezuela set the official exchange rate on Wednesday at 301.37 bolívars to the US dollar, a rate effective until January 2. That compares with 52.02 bolívars per dollar at the start of 2025, underscoring the scale of the currency’s collapse.

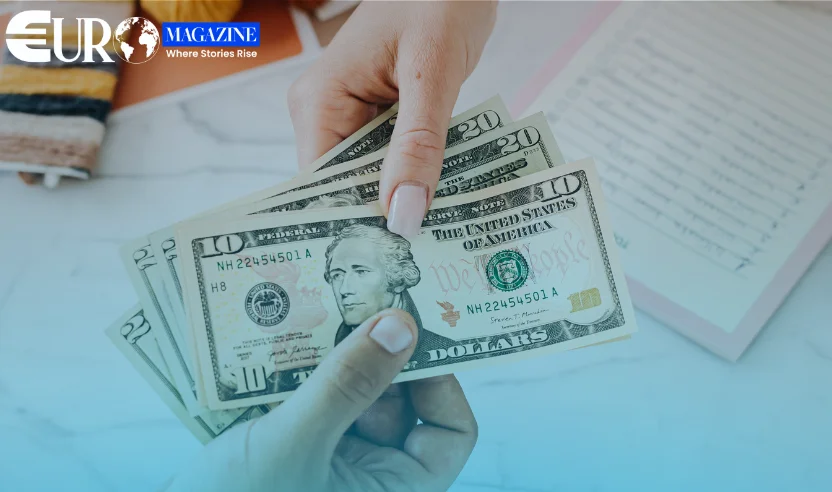

However, the official rate reflects only a fraction of the market reality. Most Venezuelans and companies are unable to obtain dollars through government channels and instead rely on unregulated parallel markets, where the dollar is trading close to 560 bolívars, a premium of roughly 85% over the official rate.

Analysts estimate that more than two-thirds of currency exchanges in Venezuela now take place through informal, crypto-based platforms, which have become the de facto source of dollar liquidity amid ongoing controls.

Daily costs rise as parallel market dominates

The widening gap between official and black-market rates has direct consequences for daily life. Prices for food, rent, transport, and imported goods are typically set using the weaker parallel rate, while many wages and pensions continue to be paid in bolívars.

Even when salaries are adjusted, real incomes continue to erode as the currency depreciates, worsening the cost-of-living crisis in an economy still grappling with persistent inflation.

Crypto platforms fill a vacuum

Over time, Venezuela has become increasingly dollarised as households and businesses seek protection from currency instability. With banks and official exchange mechanisms tightly restricted, crypto-based exchanges have emerged as an informal but widely used channel for accessing hard currency.

Supporters argue that these platforms provide a degree of stability and liquidity in an otherwise constrained financial system. Critics warn that reliance on unregulated markets increases vulnerability to price volatility and legal uncertainty.

Sanctions and oil revenues weigh on the bolívar

The currency slide comes amid rising tensions between the United States and Venezuela, with Washington tightening sanctions linked to the country’s oil trade. Venezuela has been under a US oil embargo since 2019, limiting its ability to generate dollar revenues.

President Nicolás Maduro has claimed economic growth of nearly 9% in 2025, but private estimates suggest inflation could exceed 500% this year. Official inflation data has not been published since October 2024.

Hard-currency shortages, compounded by limited access to physical dollar bills and coins, have added further strain. As sanctions have tightened and oil shipments have been seized, Venezuela has increasingly relied on unofficial crude exports at steep discounts, reducing dollar inflows and reinforcing the cycle of depreciation and rising prices.

Economists warn that without improved access to foreign currency and a shift in sanctions dynamics, pressure on the bolívar is likely to persist into 2026.