Washington: The United States’ expanding campaign to seize oil tankers linked to Venezuelan crude exports is increasingly intersecting with broader geopolitical frictions involving China, raising the risk of diplomatic fallout beyond Latin America.

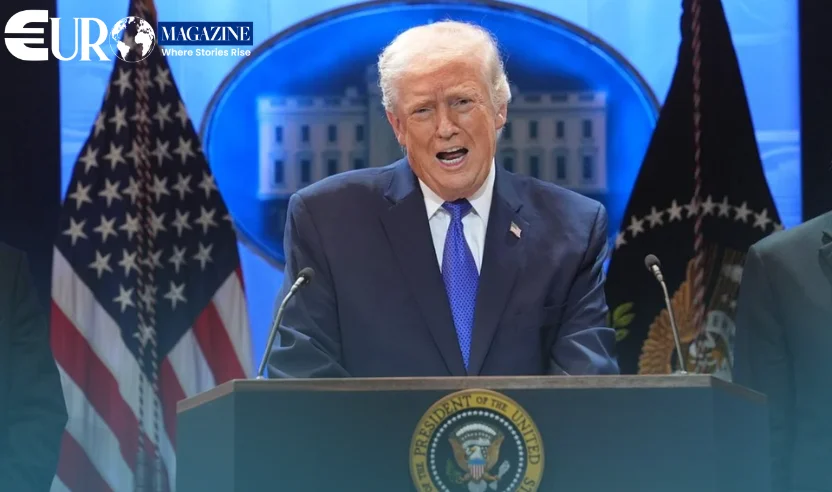

Over the weekend, U.S. authorities seized the Panama-flagged tanker Centuries while it was carrying sanctioned Venezuelan oil, a move that drew condemnation from Beijing. The action followed President Donald Trump’s declaration of a blockade targeting tankers involved in transporting Venezuelan crude, part of a renewed effort to pressure the government of Nicolás Maduro.

Maritime analysts say the seizure may signal a broader enforcement strategy that could increasingly affect shipments bound for China, which remains the dominant buyer of Venezuelan oil.

According to industry experts, the interception of Centuries likely relied on a long-standing boarding agreement between the United States and Panama, known as the Salas-Becker agreement. The framework allows U.S. authorities to board Panama-flagged vessels with limited notice, provided cooperation from Panamanian maritime authorities is secured.

Data from shipping analytics firm Kpler show that several other tankers currently operating near Venezuelan waters are also Panama-flagged and loaded with sanctioned crude. Analysts warn that those vessels could face similar enforcement action if they attempt to depart.

The implications extend well beyond Venezuela. China purchases roughly three-quarters of Venezuela’s oil output, much of it sold at discounted prices due to sanctions. Analysts say sustained disruption to those flows would force China to source heavier crude from Russia or the Middle East at higher cost.

“By tightening the squeeze on Venezuelan oil, the U.S. is not only increasing pressure on Caracas, but also affecting China’s strategic energy supply,” said Aaron Roth, a retired U.S. Coast Guard captain and security analyst. He added that prolonged enforcement could create new leverage points in U.S.–China diplomacy.

Venezuela has produced approximately 900,000 barrels per day of crude and condensate so far this year, accounting for about 1% of global supply. While the U.S. has resumed limited imports, China remains the primary destination, followed by smaller volumes to countries including Spain, Italy, and Cuba.

Shipping data indicate that vessels involved in sanctions evasion often rely on tactics such as AIS signal manipulation, ship-to-ship transfers, and flag changes to conceal destinations. In the case of Centuries, analysts detected spoofed location data prior to loading at Venezuela’s José Oil Terminal, followed by satellite imagery confirming a departure consistent with a voyage toward Asia.

A second vessel seized over the same weekend, Bella 1, was reportedly en route to Venezuela after previously transporting sanctioned oil to Chinese ports earlier this year.

The tanker seizures also intersect with growing tensions involving the Panama Canal, a strategic chokepoint at the center of U.S.–China competition. Trump has repeatedly claimed that China exerts undue influence over canal operations, an allegation denied by Panama and Beijing.

China has criticised the tanker seizures as violations of international law, while U.S. officials frame the actions as enforcement against sanctions evasion and so-called shadow-fleet activity. Analysts say any escalation involving vessels clearly bound for Chinese ports could prompt a stronger response from Beijing.

As geopolitical rivalries increasingly spill into energy markets and maritime trade, experts warn that tanker enforcement actions once viewed as narrow sanctions tools now carry wider strategic consequences.