Germany’s export-driven economic model is coming under rare and simultaneous pressure as demand from both the United States and China weakens, exposing deeper structural vulnerabilities in Europe’s largest economy, according to a new study.

For decades, Germany has been able to absorb export slowdowns by relying on strength in at least one major external market. In 2025, that buffer has disappeared. Trade data shows sharp declines in shipments to the United States alongside a sustained weakening of exports to China, pushing Germany toward a record trade deficit with Beijing of nearly €90 billion.

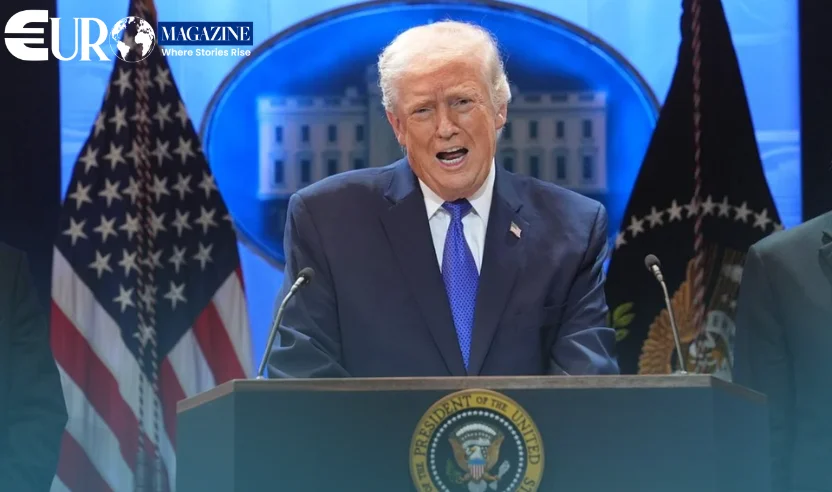

“The close transatlantic trade relationship is coming under significant strain due to U.S. President Donald Trump’s tariff policy,” said the German Economic Institute in a study funded by the Federal Foreign Office. The impact, the institute noted, is already visible in export performance during the first three quarters of 2025.

According to the report, German exports to the United States fell 7.8 percent year-on-year during the first nine months of 2025, reversing an average annual growth rate of nearly five percent recorded between 2016 and 2024.

Automotive and industrial sectors hardest hit

The decline has been concentrated in Germany’s industrial core. Exports of motor vehicles and parts, machinery, and chemical products, together accounting for more than two-fifths of German exports to the U.S. have been hit hardest. Combined, these sectors reduced overall exports to the U.S. by more than 5.2 percentage points compared with the previous year.

German automotive exports to the U.S. fell by 14 percent, while machinery exports dropped 9.5 percent, following the re-imposition of tariffs of up to 50 percent on steel, aluminium, and related products. The study warned that with U.S. import tariffs unlikely to be rolled back soon, recent export figures may represent a “new normal” for German-American trade.

Although total German exports rose slightly in nominal terms during the period, the report cautioned that this masks a significant loss of competitiveness. In key industries, export volumes have fallen back to levels last seen in 2022 or even early 2019.

China slowdown adds structural shock

At the same time, Germany is facing a second challenge from China, where export weakness reflects more structural shifts rather than trade policy alone.

While imports from China continue to rise, German exports in the opposite direction are shrinking, driving the bilateral trade imbalance toward historic highs. China is now expected to fall out of Germany’s top five export markets for the first time since 2010.

Exports to China are projected to decline by around 10 percent this year to approximately €81 billion, according to Germany Trade & Invest. That would leave China only seventh among Germany’s most important export destinations, a sharp reversal for a market that dominated German trade for more than a decade.

Analysts attribute the decline to rapid advances by Chinese manufacturers, particularly in automotive and mechanical engineering sectors, where domestic firms have narrowed the technology gap with German competitors. Beijing’s push for greater self-sufficiency has further eroded German exporters’ market share.

The study, authored by senior economist Dr. Samina Sultan, concluded that Germany can no longer rely on rebounds in its traditional export markets. Instead, it called for urgent diversification, deeper integration within the European Union, and faster progress on free-trade agreements with third countries.