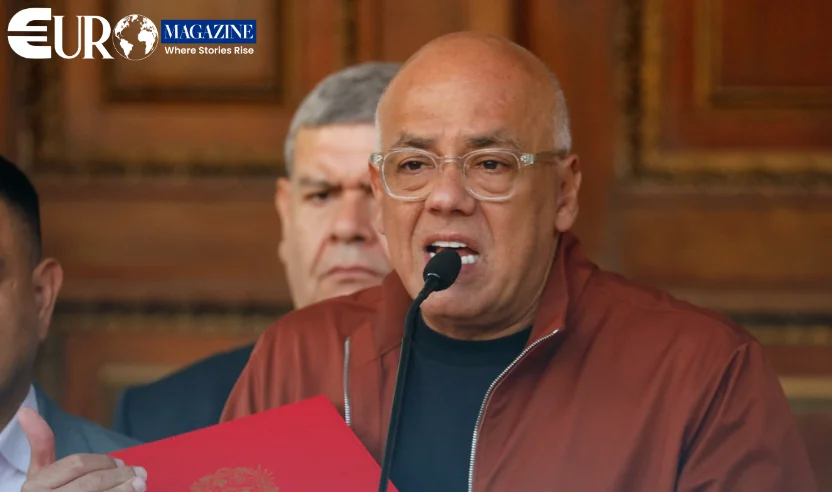

Venezuela’s interim leader Delcy Rodríguez said on Tuesday that the country has received $300 million from a U.S.-brokered sale of Venezuelan crude oil, with the funds set to be used to stabilise the nation’s struggling currency, the bolívar.

Rodríguez said the money represents part of a $500 million oil transaction carried out by Washington and will be injected into the foreign-exchange market to reduce volatility and protect workers’ purchasing power.

“The objective is to stabilise the exchange market and defend the income of Venezuelan families,” Rodríguez said, adding that the funds would be channelled through official financial mechanisms.

The announcement follows statements from Washington over the weekend claiming that U.S. President Donald Trump brokered what officials described as a “historic energy deal” allowing Venezuelan oil to be sold at market prices. Trump said proceeds from the sale would remain under U.S. oversight.

Foreign currency has played a central role in Venezuela’s economy since 2018, when hyperinflation rendered the bolívar largely ineffective and the U.S. dollar became widely used for everyday transactions. While both currencies now circulate, a prolonged shortage of dollars, exacerbated by a six-year U.S. embargo on Venezuelan oil, has driven sharp exchange-rate distortions.

Economic analysts say the government’s intervention aims to narrow the gap between the official exchange rate and the black-market rate, which has surged in recent months amid limited hard-currency inflows.

Before the U.S. capture of long-time leader Nicolás Maduro in a January 3 military operation in Caracas, Venezuela had been forced to sell its crude at steep discounts to bypass sanctions. China was its primary buyer during that period.

In December, Washington intensified enforcement of oil sanctions by seizing tankers carrying sanctioned Venezuelan crude, further restricting unofficial exports.

A Panamanian-flagged tanker was seen earlier this week loading crude on Lake Maracaibo, highlighting renewed but tightly controlled export activity following the latest political and diplomatic developments.